The simple fact that the Irish and the British economies are very closely integrated, with Ireland depending very strongly on exports to and imports from Britain means Ireland may lose almost as the UK from a Brexit.

In 2014 Ireland exported €14.61bn worth of goods to the United Kingdom. This figure represented 13.1% of exports from Ireland and 3.2% of imports to the United Kingdom.

In 2014 the United Kingdom exported €17.24bn worth of goods to Ireland. This amounted to 5.5% of exports from the United Kingdom and 35.6% of imports to Ireland.

According to the UK Trade & Investment Office, the main exports from the UK to Ireland (by value) are:

- Fuel and lubricants

- Manufactured articles

- Machinery

- Transport

- Food and live animals

- Chemicals

In fact, Ireland is the UK’s largest export market in food and drink, and second largest market in clothing, fashion and footwear.

The following graph (generated through our trade visualization tool GED VIZ) makes it clear how the Irish economy is dependent on trade with the United Kingdom.

[iframe “<iframe src=”//viz.blogs.bertelsmann-stiftung.de/globaleurope/3214?lang=en” width=”800″ height=”600″ style=”border: 1px solid #eee” mozallowfullscreen=”true” webkitallowfullscreen=”true” allowfullscreen=”true”><a href=”//viz.blogs.bertelsmann-stiftung.de/globaleurope/3214?lang=en” target=”_blank”>GED VIZ Slideshow</a></iframe>”]

Currently benefits for UK businesses exporting to Ireland include the common membership to the European Union. Thus, British goods are exempt from import duties and common standards and technical regulations, to some extent, apply.

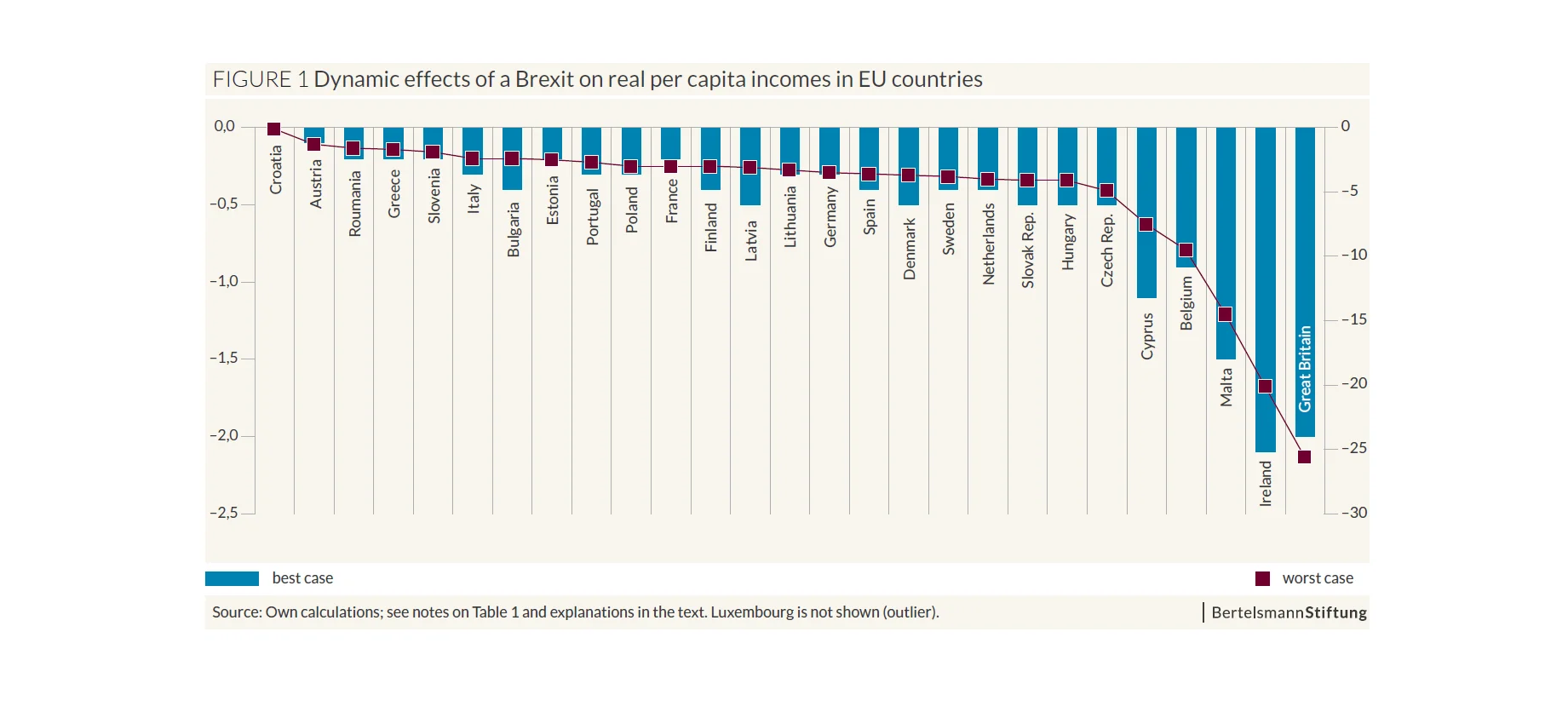

Our recent study on the Dynamic effects of Brexit for all EU countries has computed these effects. This study once again shows that a British withdrawal from the EU would have negative economic consequences for all 28 EU countries, especially for the UK itself. As we said in April this year: A Brexit would be a losing game for everyone in Europe.

But the upcoming UK in-out referendum on staying or leaving the European Union will have an especially substantial impact on the Irish economy.

Static Effects

In our static analysis, the country which would suffer most from a Brexit is the UK, followed by Ireland, Luxembourg, Malta, Cyprus and Belgium. [1]

Dynamic Effects

Ireland’s economic dependence on British exports and imports would mean a –20.1% change in real per capita income (in the worst case scenario) and a –2.1% (in the best case scenario). In fact, in the best case scenario, Ireland would suffer a higher decrease in real per capita income (-2.1%) than the UK (-2.0%). [2]

European countries that would have to absorb above average losses due to a Brexit are led by Ireland, followed by Luxembourg, Belgium, Sweden, Malta and Cyprus.

Do not miss our animated video on The Costs of Leaving the EU due to a Brexit

You might be also interested in our studies on Brexit:

Dynamic Effects of Brexit for all EU countries

Costs and benefits of a United Kingdom exit from the European Union